Study of Final Business Case Sensitivity Analysis in the Government and Business Entity Cooperation (KPBU) Project in the Drinking Water Sector

DOI:

https://doi.org/10.24036/cived.v11i3.654Keywords:

sensitivity analysis, PPP project, final business caseAbstract

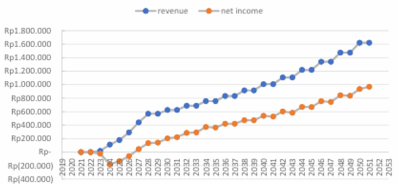

The purpose of this study is to analize sensitivity of the final business case in public private partnership (PPP) projects. The outcome of this study will provide an overview and limits on changes in the parameters forming the investment. Therefore, a sensitivity analysis was carried out to changes in price, initial cost and interest. The results of the study shows the three changes show that the most sensitive parameter is price changes. Meanwhile, due to the decrease in absorption volume at the offtaker in Jakarta, two efforts were made, namely by increasing the minimum tariff to Rp. 3,846, - or by increasing the concession period to 45 years, this project can be said to be investment worthy.

Downloads

References

Akintoye et al. (2023), ‘Recurrent Aphthous Stomatitis’, Dental Clinics of North America, 58(2).

Black and Scholes, (2020), The Effects on Dividend Yield and Dividend Policy on Common Stock Prices and Returns. Journal of Financial Economics. Vol. 4. No. 1.

Brigham, E. F., & Ehrhardt, M. C. (2020). Financial Management: Theory and Practice. Cengage Learning.

Grimsey and Lewis (2019), Public Private Partnerships:The Worldwide Revolution in Infrastructure Provision and Project Finance. Cheltenham,UK: Edward Elgar Publishing Limited.

Hoyer, W. D., & Hoyer, W. D. (2019). Customer Behavior. Cengage Learning.

Jensen and Meckling, (2021), Theory of The Firm : Management Behavior, Agency Cost ad Ownership Structure. Journal of Financial Economics. V.3, No. 4.

Kotler and Keller (2020). Marketing Management, 15th Edition New. Jersey: Pearson Prentice Hall, Inc.

M. J. C. van der Meer-Kooistra and J. M. H. J. Haan (2021),

Modigliani and Miller's (2022). The Cost of Capital, Corporation Finance and. The Theory of Investment, The American Economic Review, Vol 48 No.3.

Myers, and Allen (2019). Principles of Corporate Finance. McGraw Hill Education.

Ross, S. A., Westerfield, R. W., & Jaffe, J. (2021). Corporate Finance. McGraw-Hill Education.

Ross, Westerfield, and Jaffe (2021). Corporate Finance (9th ed.). McGraw-Hill Companies.

Yescombe (2019), Public Private Partnership “Principles Of Policy And. Finance”. London: Elsevier.

Zhang et al. (2019), Breast cancer development and progression: Risk factors, cancer stem cells, signaling pathways, genomics, and molecular pathogenesis. Genes Dis. Vol. 5(2).

Downloads

Published

Issue

Section

License

Copyright (c) 2024 Feby Wucika Jasmin, Taufika Ophiyandri

This work is licensed under a Creative Commons Attribution 4.0 International License.